Why Indians Are Moving Back to Fixed Deposits in 2026 — And What It Means for Your Money

Fixed Deposit Trend in India 2026: Why Indians Are Moving Back to Fixed Deposits—and What It Means for Your Wealth

Introduction: Fixed Deposit Trend in India

The Silent Comeback of FDsAfter a decade dominated by equity mutual funds, direct stocks, and aggressive market-linked products, a remarkable shift has emerged: Indians Are Moving Back to Fixed Deposits in 2026. The fixed deposit trend in India is no longer a whisper on finance forums—it is a mainstream pivot toward safety, predictability, and peace of mind. What has changed, and how should you react? Let’s break it down.

The New Investor Mindset: Fixed Deposit Trend in India

Stability Over SpeedFor years, the mantra was “growth at any cost.” But the roller-coaster ride of recent market cycles has altered investor psychology. Households planning children’s education, home purchases, or retirement now ask a different question: “How much risk can I truly tolerate?” The guaranteed returns of fixed deposits (FDs) deliver the emotional comfort that volatile assets cannot. Certainty, in short, has regained its lost charm.

Rising Interest Rates Put FDs Back in the Spotlight

Low FD rates once made them an afterthought. Not anymore. In 2026, banks compete fiercely for deposits, offering attractive yields—especially on long-tenure and senior-citizen schemes. Today’s FD offers:• Predictable, fixed returns• Higher rates for seniors and loyal customers• No daily monitoring or rebalancing headachesFor many families, the trade-off of slightly lower returns for guaranteed income feels more than fair.

Market Volatility Reshapes Portfolio Strategy

Seasoned investors know bull runs do not last forever. After multiple corrections, they are embracing rebalancing rather than exiting equities outright. Fixed deposits play three crucial roles:• A stabilizing anchor in diversified portfolios• A safe harbor for short-term goals (up to five years)• A psychological buffer that reduces panic selling during market dipsThis shift signals realism, not pessimism.

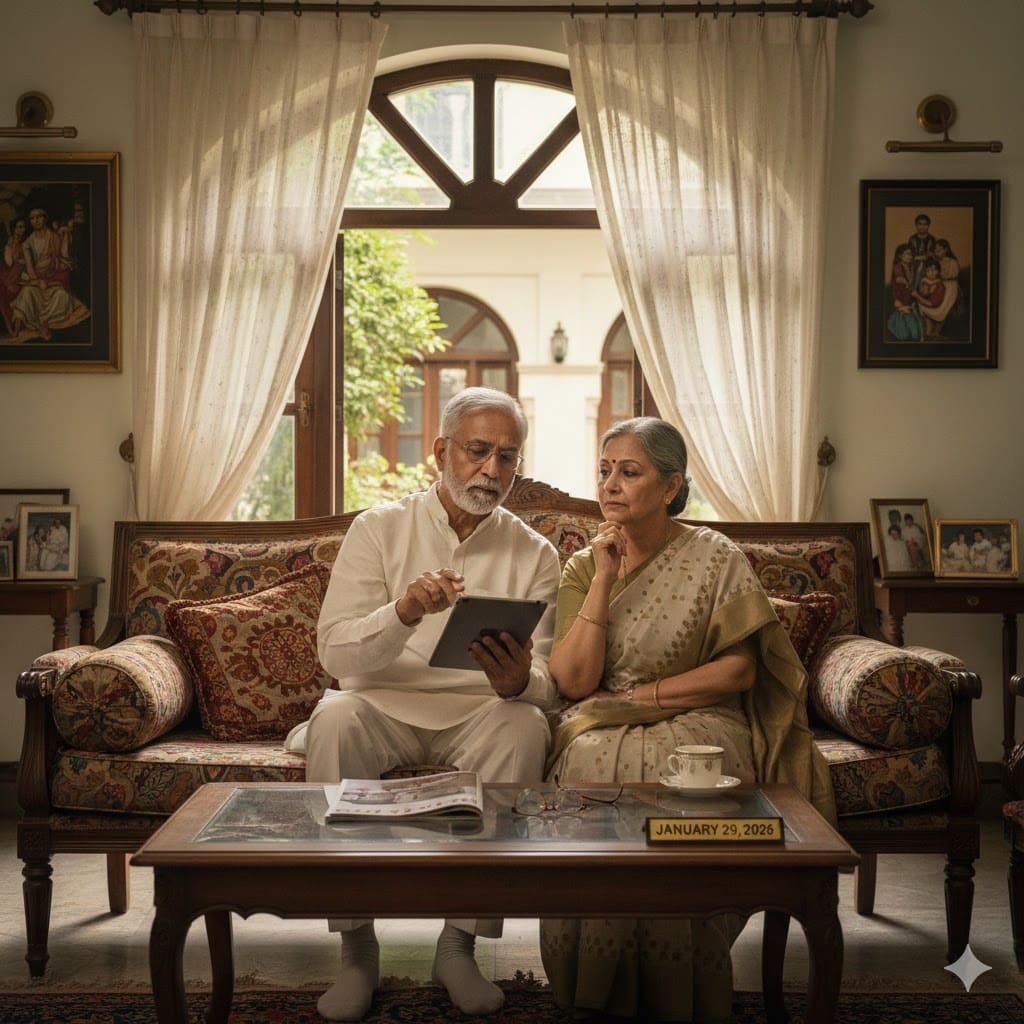

Senior Citizens:

The Vanguard of the FD RevivalRetirees face rising healthcare costs and longer life expectancies. They value dependable cash flow over spectacular gains. With banks offering preferential FD rates—often 0.25%–0.50% higher—seniors naturally lead the resurgence. Clear timelines and regular interest payouts help them budget medical, lifestyle, and emergency expenses with confidence.

The Trust Factor:

Why Banks Still Win on SafetyTrust remains a cornerstone of Indian finance. Banks, backed by regulatory oversight and deposit insurance, project a sense of security that newer digital platforms cannot easily replicate. While stock prices swing in response to geopolitical tweets, fixed deposits sit quietly, earning interest. This perceived insulation from global chaos is a powerful draw in 2026.

Practical Implications for Your Portfolio

The renewed fixed deposit trend in India offers three strategic takeaways:a. Stability Carries Real Monetary ValueVolatility can erode not just wealth but also discipline. A stable core lets you hold riskier assets for the long haul.b. FDs Remain Relevant ToolsUse them for emergency funds, planned expenses inside five years, or as an income ladder in retirement.c. Balance Outperforms ExtremesNo single asset class—equities, debt, real estate, or gold—should dominate your portfolio. Allocate across them to protect and grow wealth consistently.

Who Should Prioritize Fixed Deposits?

• Risk-averse investors who lose sleep over market swings• Seniors seeking regular, predictable income• Families with near-term liabilities such as tuition fees or a down payment• First-time investors building an emergency fundConversely, young professionals with long investment horizons can still lean toward equities—yet even they benefit from parking short-term cash in FDs to avoid forced exits during market crashes.

Striking the Perfect Balance:

FDs, Equities, and BeyondA sample diversified plan for 2026 might look like this:• 20%–30% in fixed deposits and short-term debt for stability• 40%–60% in equity mutual funds or index ETFs for long-term growth• 10%–15% in gold, REITs, or other alternatives as inflation hedges• 5%–10% in liquid cash for emergenciesAdjust these weights to match your age, goals, and risk tolerance.

Conclusion: Fixed Deposit Trend in India

Clarity, Control, and ConsistencyThe fact that Indians Are Moving Back to Fixed Deposits in 2026 is not a story of retreat; it is a story of financial maturity. By recognizing the value of certainty and blending it with growth assets, investors are building portfolios that not only accumulate wealth but also preserve peace of mind. In an era of information overload and market noise, choosing clarity over complexity may be the smartest investment decision you make this year.

Also Read-

https://topupdates.in/8-percent-fd-rates-for-seniors/