Use the 8th CPC salary calculator 2026 fitment factor grade wise guide to estimate revised basic pay, allowances, DA, HRA and arrears easily.

The 8th CPC salary calculator 2026 fitment factor grade wise guide helps central government employees estimate their revised basic pay, allowances, DA, HRA, NPS contribution and arrears under the expected new pay structure. With rising discussions around the 8th Pay Commission, understanding the grade-wise salary impact and fitment multiplier has become essential for financial planning.

Anticipated Major Changes from 7th Pay Commission Structure

When the 8th Pay Commission replaces the 7th, most staff expect a higher fitment factor, which means basic pay will rise before any extras are added, giving a better jump in each pay level of the matrix. Many think the new matrix will have wider gaps between levels so that promotions bring a clearer boost in income. Dearness Allowance, which now moves twice a year, may be merged with basic pay once the allowance crosses a set mark, making pay slips less cluttered and pensions larger.

House rent and travel allowances could shift to a city-wise slab system that ties rates to real market costs instead of old grade pay rules. For pensioners, a fresh formula may blend service length with last drawn pay to avoid sharp falls after retirement. The panel is also likely to push for more online claims and less paperwork, cutting wait time and making life easier for every employee and retiree.

These structural changes make the 8th CPC salary calculator 2026 fitment factor grade wise framework even more important for accurate pay projections.

Central Government Salary Structure – Basic Understanding

In India, the salaries of central government employees are determined by the Central Government of India, and they are revised periodically through the Pay Commission system.

At present, the salary structure is based on the Pay Matrix introduced under the 7th Central Pay Commission.

Salary Structure Components:

- Basic Pay

- Dearness Allowance (DA)

- House Rent Allowance (HRA)

- Transport Allowance (TA)

- Other Special Allowances

Pay Matrix Level-Wise Classification (Level 1–18)

The 8th CPC salary calculator 2026 fitment factor grade wise system allows employees to compare their current 7th CPC basic pay with projected revised salary using expected multipliers. This comparison helps in understanding grade-wise impact across different pay levels.

The following pay matrix level 1 to 18 structure supports the 8th CPC salary calculator 2026 fitment factor grade wise model by showing how each pay level may be impacted after applying the projected multiplier.

| Level | Approx Basic Pay (₹) | Classification | Typical Category |

| Level 1 | 18,000 | Group C | MTS, Support Staff |

| Level 2 | 19,900 | Group C | LDC |

| Level 3 | 21,700 | Group C | Technician |

| Level 4 | 25,500 | Group C | Clerk |

| Level 5 | 29,200 | Group C | Senior Clerk |

| Level 6 | 35,400 | Group B | Inspector |

| Level 7 | 44,900 | Group B | Section Officer |

| Level 8 | 47,600 | Group B | Assistant Director |

| Level 9 | 53,100 | Group B | Gazetted |

| Level 10 | 56,100 | Group A | Entry Level Officer |

| Level 11–13 | 67,700 – 1,23,100 | Group A | Senior Officers |

| Level 14–18 | 1,44,200 – 2,50,000 | Apex | Secretaries |

This structure is based on the 7th Central Pay Commission (7th CPC).

Group-Wise Classification Explained

Group C

- Clerical & technical staff

- Lower entry-level posts

- Largest employee segment

Group B

- Supervisory roles

- Mid-level officers

Group A

- Gazetted Officers

- Administrative & decision-making roles

How Grade Progression Works

- Annual increment ≈ 3% of Basic

- Promotion → Next Pay Level jump

- The MACP (Modified Assured Career Progression) scheme is applicable.

Expected Changes Under 8th Pay Commission (Projection Section)

If the fitment factor under the 8th CPC falls between 2.6 and 3.0, then:

- Level 1 may increase from ₹18,000 to ₹45,000+

- Level 10 may increase from ₹56,100 to ₹1,40,000+ (approximate projection)

Based on these projections, the 8th CPC salary calculator 2026 fitment factor grade wise method becomes the most reliable way to estimate potential salary growth.

Salary Calculation Formula: Step-by-Step Mathematical Framework (8th Pay Commission Ready Guide)

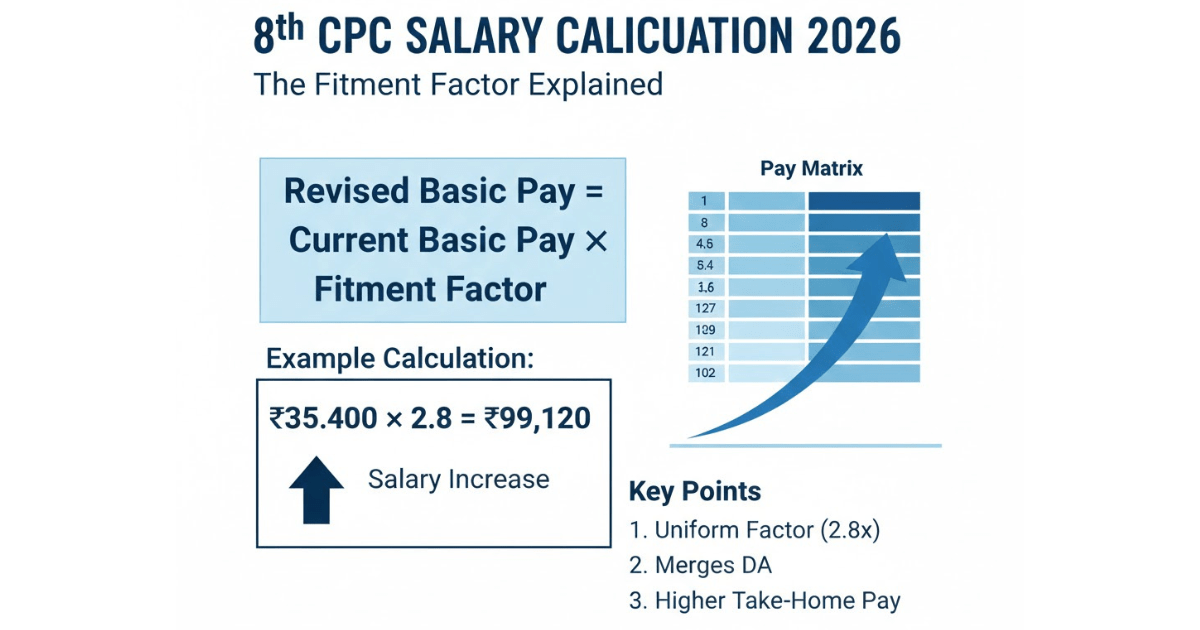

Revised Basic Pay Formula (Fitment Factor Method)

If the 8th Pay Commission is implemented, the revised basic pay calculation will be based on the fitment factor formula explained below.

Formula:

Revised Basic=Current Basic×Fitment Factor

Example:

Suppose:

-

Current Basic = ₹35,400

-

Fitment Factor = 2.86

35,400×2.86=₹1,01,244

👉 This will become the new Basic Pay(projection basis).

This formula is the core of the 8th CPC salary calculator 2026 fitment factor grade wise calculation system used to estimate revised pay levels.

The expected fitment multiplier is projected to range between 2.6 and 3.0, depending on inflation trends and government approval patterns.

Dearness Allowance (DA) Calculation

DA is generally calculated on the revised Basic Pay.

Formula:

DA=Revised Basic×DA%

If DA = 42%

1,01,244×42%=₹42,522

House Rent Allowance (HRA)

HRA depends on the category of the city:

| City Category | HRA % |

|---|---|

| X | 27% |

| Y | 18% |

| Z | 9% |

Formula:

HRA=Revised Basic×HRA%

Gross Salary Formula

Gross Salary=Basic+DA+HRA+TA+Other AllowancesGross\ Salary = Basic + DA + HRA + TA + Other\ Allowances

Example:

| Component | Amount (₹) |

|---|---|

| Basic | 1,01,244 |

| DA | 42,522 |

| HRA | 27,335 |

| TA | 3,600 |

| Total Gross | ₹1,74,701 |

Deductions

Common deductions:

-

NPS (10% of Basic + DA)

-

CGHS

-

Income Tax

-

Professional Tax

Employees contributing to provident funds should also stay informed about the UPI-based EPF withdrawal system expected in 2026, which may simplify fund access significantly.

Employees should also be aware of recent legal developments affecting provident fund contributions, including the Supreme Court’s EPF wage ceiling review and its impact on salaried employees.

Related Guides

Supreme Court’s EPF wage ceiling review and its impact on salaried employees

NPS Formula:

NPS=(Basic+DA)×10%

Net Take-Home Salary

Net Salary=Gross Salary−Total Deductions

Apart from NPS deductions, employees should also stay updated on recent changes in provident fund regulations. You can review the latest key changes in EPF rules (old vs new comparison) to understand how retirement savings may be impacted.

Related Guides

8th Pay Commission Complete Overview

Pension Calculation Framework

Pension revision can also be estimated using the 8th CPC salary calculator 2026 fitment factor grade wise projection model.

For retirees:

Basic Pension=50%×Last Drawn Basic

If the Fitment Factor is applied:

Revised Pension=Current Pension×Fitment Factor

Example: Salary Comparison Under Different Fitment Multipliers

| Current Basic (₹) | Fitment 2.6 | Fitment 2.8 | Fitment 3.0 |

|---|---|---|---|

| 35,400 | 92,040 | 99,120 | 1,06,200 |

Salary Comparison Based on Different Fitment Multipliers

The comparison table above illustrates how different fitment multipliers can significantly impact revised salary levels under the 8th CPC framework. Even a small variation in the approved multiplier can result in a noticeable difference in the final basic pay and overall gross salary.

For example, if the current basic pay is ₹35,400, applying a fitment multiplier of 2.6 will produce a lower revised basic compared to a multiplier of 2.8 or 3.0. This difference becomes even more substantial at higher pay matrix levels. Employees in Level 10 or above may experience a larger absolute increase because the multiplier is applied to a higher base amount.

Understanding these projections helps employees estimate possible salary outcomes before official approval. It also allows better planning for tax liabilities, retirement contributions, and financial commitments. While the final multiplier will depend on government recommendations and fiscal considerations, analyzing multiple scenarios gives a realistic expectation of salary growth under the 8th CPC salary calculator 2026 fitment factor model.

Advanced Salary Comparison Across Pay Matrix Levels

The table below compares projected revised basic pay across multiple pay matrix levels under different expected fitment multipliers.

| Pay Level | Current Basic (₹) | Fitment 2.6 | Fitment 2.8 | Fitment 3.0 |

|---|---|---|---|---|

| Level 1 | 18,000 | 46,800 | 50,400 | 54,000 |

| Level 6 | 35,400 | 92,040 | 99,120 | 1,06,200 |

| Level 10 | 56,100 | 1,45,860 | 1,57,080 | 1,68,300 |

Related Guides

Retirement planning myths that create financial stress

Arrears Calculation Formula (If Retrospective Implementation)

Arrears=(New Salary−Old Salary)×Number of Months

Employees using the 8th CPC salary calculator 2026 fitment factor grade wise approach can also estimate pending arrears accurately.

Mathematical Flow Summary

- Multiply Basic by Fitment Factor

- Calculate DA

- Add HRA + TA

- Deduct NPS + Tax

- Arrive at Net

For detailed projections, refer to the 8th CPC salary calculator 2026 fitment factor grade wise table provided above to compare grade-level salary revisions accurately.

How 8th CPC Salary Calculator 2026 Fitment Factor Grade Wise Works in Real Scenario

In a real-world scenario, the 8th CPC salary calculator 2026 fitment factor grade wise method starts by identifying the employee’s current pay level under the 7th CPC matrix. The current basic pay is multiplied by the expected fitment factor (for example 2.6–3.0), and the revised figure becomes the new projected basic pay.

Next, allowances such as DA, HRA and TA are recalculated on the updated basic. This allows employees across different grades to clearly understand how much salary increase they may receive under the 8th CPC salary calculator 2026 fitment factor grade wise framework. The grade-wise table further ensures accurate comparison across Level 1 to Level 18 employees.

Expected Implementation Schedule and Rollout Phases

The 8th Pay Commission is likely to follow a timeline that is quite similar to earlier pay panels. If the government sets up the commission by early 2024, members may take about a year to study pay data, meet staff groups, and draft their report. This puts the first full report around mid-2025.

After that, the finance and cabinet teams usually need three to six months to look at the numbers, make small changes, and give the final green light. Once the cabinet clears the plan, the new pay scales could take effect from 1 January 2026, which lines up with the ten-year gap since the 7th Pay Commission.

According to updates from the Ministry of Finance, pay commission recommendations are typically reviewed before final approval.

Pay hikes often reach workers in two or three waves. First, basic pay and grade pay change on the day the plan starts. Next, all linked perks—such as house rent, travel, and medical aid—get revised within the next two quarters. Last, any pending arrears are paid, often in two parts, so that the budget can absorb the extra load. If this track record holds, most staff should feel the full benefit by late 2026.

As implementation approaches, the 8th CPC salary calculator 2026 fitment factor grade wise tool will help employees compare old vs revised pay effectively.

Arrears Calculation and Payment Distribution Methods of the 8th Pay Commission

If the 8th Pay Commission is implemented with retrospective effect (for example, from 1 January 2026), employees may receive arrears for the period between the effective date and the actual date of implementation.

Arrears are calculated as the difference between the revised salary and the old salary, multiplied by the number of pending months. The government may choose to distribute arrears either as a lump-sum payment or in installments, depending on fiscal considerations.

Arrears Calculation Formula

Arrears=.(Revised Salary−Old Salary)×Number of Months

Example Calculation

Below example explains how the 8th CPC salary calculator 2026 fitment factor grade wise framework estimates arrears.

| Component | Amount (₹) |

|---|---|

| Old Monthly Salary | 70,000 |

| Revised Monthly Salary | 90,000 |

| Difference | 20,000 |

| Pending Months | 6 |

| Total Arrears | 1,20,000 |

Possible Payment Methods

| Method | Description |

|---|---|

| Lump Sum | Entire arrears paid at once |

| Installments | Paid in 2–4 phased payments |

| Partial + Balance | Some amount upfront, rest later |

Transition Support and Employee Preparation Guidelines for the 8th Pay Commission

The 8th CPC salary calculator 2026 fitment factor grade wise framework provides a structured way to understand revised salary projections, grade-level impacts, and allowance adjustments. By applying the fitment multiplier and grade-wise tables correctly, employees can estimate their expected pay revision and plan finances confidently ahead of implementation.

Before implementation, employees are advised to use the 8th CPC salary calculator 2026 fitment factor grade wise method to prepare for financial adjustments.

With a projected salary hike under the 8th CPC framework, employees should also avoid common financial errors that can reduce long-term wealth. Reviewing key financial mistakes to avoid in 2026 can help in smarter money management.

Related Guides-

key financial mistakes to avoid in 2026

Employee Preparation Checklist

| Area of Preparation | Action Required | Purpose |

|---|---|---|

| Service Records | Verify pay level, promotions, MACP status | Ensure correct pay fixation |

| Salary Estimation | Use fitment factor projections | Estimate revised basic pay |

| Tax Planning | Recalculate income tax liability | Avoid tax surprises |

| NPS Contribution | Check revised Basic + DA impact | Plan retirement corpus |

| Loan & EMI Review | Adjust repayment strategy | Optimize financial planning |

By staying informed and proactive, employees can smoothly transition into the revised pay system and make better financial decisions under the 8th Pay Commission framework.

People Also Ask About 8th CPC Salary Calculator 2026

1. What is the expected fitment multiplier in 8th CPC 2026?

The expected fitment multiplier under the 8th CPC is projected to range between 2.6 and 3.0. However, the final multiplier will depend on government approval, inflation trends, and recommendations made by the pay commission panel.

2. How is revised basic pay calculated under 8th CPC?

The revised basic pay calculation is done by multiplying the current basic pay with the approved fitment factor. Once the new basic is determined, allowances such as DA and HRA are recalculated based on the updated amount.

3. How will pay matrix level 1 to 18 be affected in 8th CPC?

Under the new structure, pay matrix level 1 to 18 salaries are expected to increase proportionately according to the approved fitment multiplier. Higher levels may see a significant jump in gross pay due to allowance adjustments and revised slabs.

Conclusion

The 8th CPC salary calculator 2026 fitment factor grade wise framework provides a structured way to understand revised salary projections, grade-level impacts, and allowance adjustments. By applying the fitment multiplier and grade-wise tables correctly, employees can estimate their expected pay revision and plan finances confidently ahead of implementation.

The new pay commission is expected to introduce improved basic pay scales, revised allowance structures, and enhanced digital tools for salary calculations. Understanding these changes through proper calculation methods and grade-wise tables will help employees prepare for the transition and maximize their compensation benefits.

Government employees can utilize the detailed formulas and calculator tools outlined in this guide to estimate their potential salary increases and plan their finances accordingly. The implementation timeline and practical considerations provide essential information for navigating the transition period effectively.

Using the 8th CPC salary calculator 2026 fitment factor grade wise approach ensures clarity in salary projection before official implementation.

Frequently Asked Questions (FAQs)

Q1: When will the 8th Pay Commission be officially announced and implemented?**

A: While no official announcement has been made, following the 10-year pattern, the 8th Pay Commission is expected to be constituted around 2025-2026, with implementation likely by 2026-2027.

Q2: How much salary increase can government employees expect from the 8th Pay Commission?**

A: Based on historical trends and inflation adjustments, employees may expect a fitment factor of 2.5 to 3.0 times their current basic pay, though official recommendations are pending.

Q3: Will the 8th Pay Commission apply to both central and state government employees?**

A: The 8th Pay Commission will directly apply to central government employees. State governments typically adopt similar structures with their own modifications and implementation timelines.

Q4: How can I calculate my expected salary under the 8th Pay Commission?**

A: Use the grade-wise tables and multiplication formulas provided in this guide, or utilize online calculators with your current pay scale and grade information for accurate projections.

Q5: What documents will be required during the 8th Pay Commission implementation?**

A: Employees will typically need their current pay slip, grade confirmation, service records, and any relevant allowance documentation for proper pay fixation verification.

Q6: How will pension calculations be affected by the 8th Pay Commission?**

A: Pension calculations for retired employees will be revised based on the new pay scales, with benefits typically calculated using the same fitment factors applied to serving employees.

Q7: How does the 8th CPC salary calculator 2026 fitment factor grade wise method work?

A: It multiplies the current basic pay by the projected fitment factor and applies grade-wise pay matrix adjustments to estimate revised salary and allowances.

Q8: Is the 8th CPC salary calculator 2026 fitment factor grade wise method accurate?

A: It provides projected calculations based on expected fitment multipliers and grade-wise pay tables.

Q9: Who should use the 8th CPC salary calculator 2026 fitment factor grade wise guide?

A: All central government employees who want to estimate revised pay before official notification.